**Bitcoin Price Soars to $117K Following Trump’s 401(k) Crypto Order**

Bitcoin has surged past $117,500 today, bouncing back from a recent low of $114,278 just a day prior, as reported by market data. This significant rebound coincides with President Donald Trump’s signing of a groundbreaking executive order that permits cryptocurrencies, including Bitcoin, to be integrated into 401(k) retirement accounts.

The executive order mandates the Department of Labor to reassess its existing guidelines regarding fiduciary responsibilities in ERISA-governed plans. It aims to clarify the process for offering diversified funds that encompass alternative investments. Furthermore, the order calls for collaboration among the Department of Labor, the Treasury Department, the Securities and Exchange Commission (SEC), and other federal regulators to evaluate whether broader regulatory updates are necessary to support this policy change. The SEC is specifically tasked with revising its rules to facilitate access to these investment options, marking a pivotal step toward modernizing retirement investment strategies for millions of Americans.

According to a White House fact sheet, “President Trump aims to provide American workers with more investment choices to achieve stronger and more financially secure retirement outcomes.” It highlights that alternative assets, such as private equity, real estate, and digital assets, can offer competitive returns and diversification benefits.

Mike Novogratz, CEO of Galaxy Digital, emphasized the potential impact of this executive order, predicting that a “monster pool of capital” will gain exposure to Bitcoin and other cryptocurrencies as a result. He noted that “tons of money” will be flowing into the market.

The fact sheet also reiterated President Trump’s commitment to establishing the United States as the “crypto capital of the world,” underscoring the importance of embracing digital assets to foster economic growth and technological leadership.

Ryan Rasmussen, Head of Research at Bitwise, illustrated the potential influx of capital into Bitcoin, suggesting that if cryptocurrencies capture a small percentage of the $8 trillion 401(k) market, the financial implications could be substantial. For instance, capturing just 1% could translate to $80 billion, while 10% could result in a staggering $800 billion.

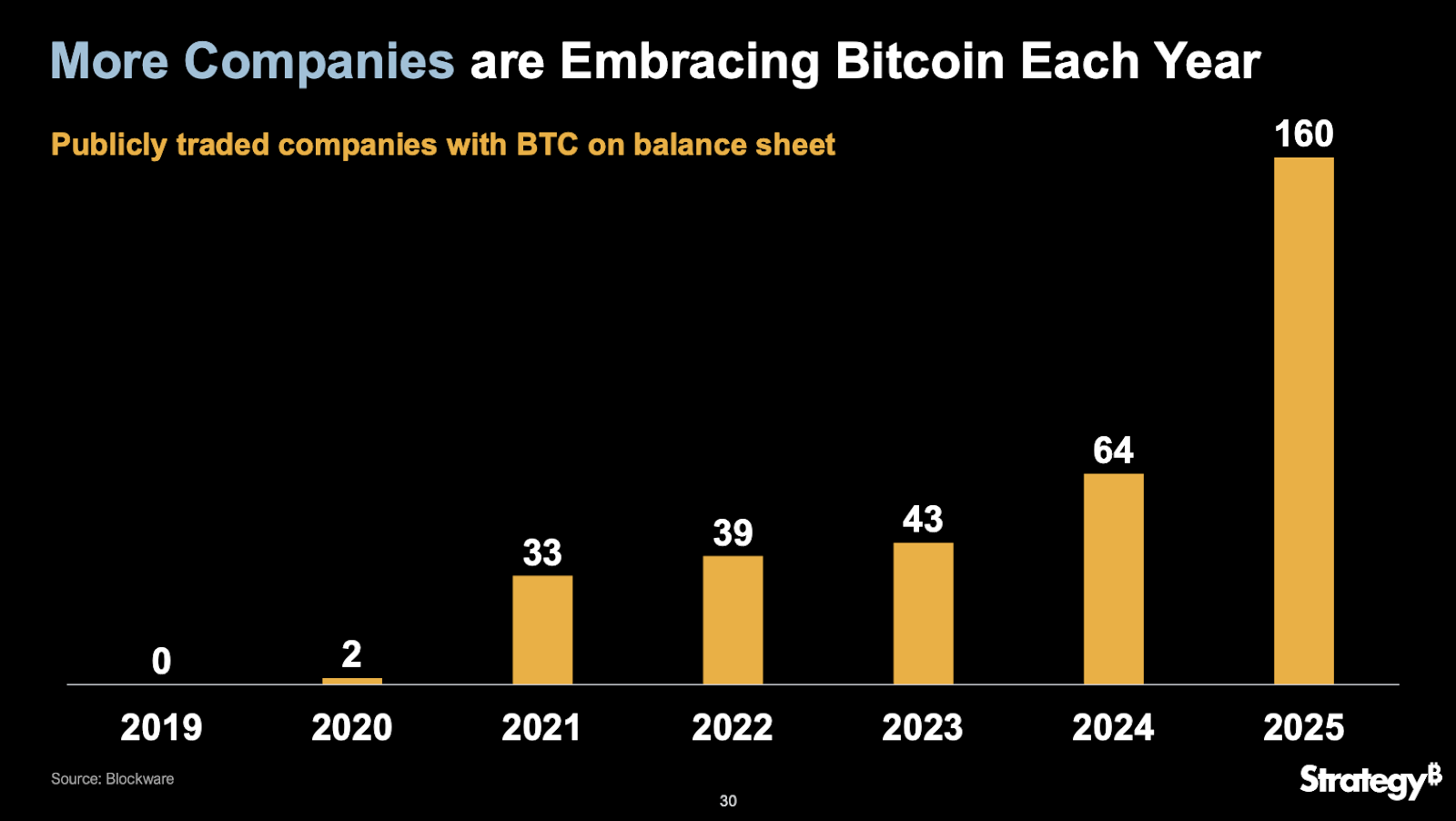

This policy shift is poised to be a significant catalyst for Bitcoin adoption, further fueling the growing institutional interest that has been developing over the years.

**FAQ**

**Q: How will Trump’s executive order affect Bitcoin investments in 401(k) accounts?**

A: The executive order allows cryptocurrencies like Bitcoin to be included in 401(k) retirement accounts, potentially opening up a significant new market for Bitcoin investments and increasing institutional interest in digital assets.