**Bitcoin Corporate Treasury Firm Acquires 21,021 BTC Post $2.52 Billion IPO**

**Meta Description:** Strategy, a leading bitcoin treasury firm, purchases 21,021 BTC for $2.46 billion following a successful IPO, boosting its total holdings significantly.

**URL Slug:** strategy-bitcoin-acquisition-ipo

**Bitcoin Corporate Treasury Firm Acquires 21,021 BTC Post $2.52 Billion IPO**

In a significant move for the cryptocurrency market, Strategy, a prominent corporate treasury firm focused on Bitcoin, has announced the acquisition of 21,021 BTC at an average price of $117,256. This purchase was made possible through the proceeds from its recent $2.52 billion initial public offering (IPO) of Series A Perpetual Stretch Preferred Stock (STRC). This strategic acquisition elevates Strategy’s total Bitcoin holdings to 628,791 BTC, valued at approximately $80 billion.

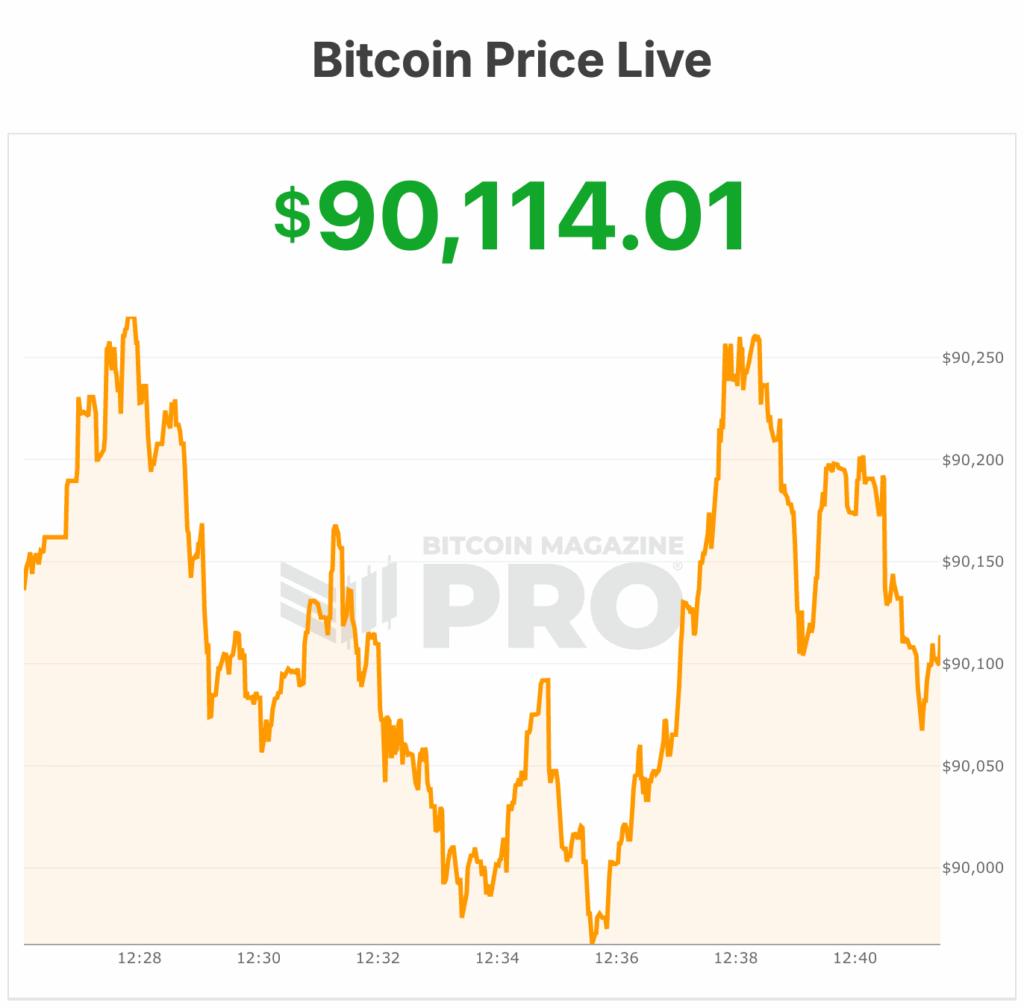

The IPO, which priced shares at $90 each for a total of 28,011,111 shares, marks the largest U.S. IPO of 2025 and stands as one of the most substantial equity raises related to Bitcoin in recent history. After expenses, Strategy netted around $2.474 billion, utilizing nearly the entirety of this amount to further its aggressive Bitcoin accumulation strategy without diluting the interests of common shareholders. The stock is expected to begin trading on the Nasdaq Global Select Market around July 30 under the ticker STRC.

This innovative stock offering features a variable 9% annual dividend, paid monthly, and is designed to trade close to its $100 par value. Notably, it represents the first U.S. exchange-listed perpetual preferred security from a Bitcoin treasury firm that offers a monthly dividend rate. As of July 29, 2025, Strategy has achieved a Bitcoin yield of 25.0% year-to-date.

The issuance of this preferred stock is the largest of its kind since 2009, introducing a short-duration, income-generating security aimed at yield-focused investors. Strategy also maintains rights for redemption and repurchase, along with investor protections such as dividend accrual and tax-related redemption options.

In a related development, just a week prior, Strategy revealed a $740 million Bitcoin purchase of 6,220 BTC, pushing its total holdings well above the 600,000 BTC mark. Analysts from TD Cowen project that the company could acquire an additional 17,000 BTC over the next decade under its 42/42 program, which aims to raise $84 billion for Bitcoin purchases by 2027.

In conclusion, Strategy’s recent acquisition and IPO highlight the growing trend of institutional investment in Bitcoin, signaling a robust future for cryptocurrency in corporate treasury management.

**FAQ**

**What is Strategy’s recent Bitcoin acquisition?**

Strategy has purchased 21,021 BTC for approximately $2.46 billion following a successful IPO, increasing its total Bitcoin holdings to 628,791 BTC.